Imagine you’re in the market for a used car and you’re on the forecourt. The salesmen? Well, let’s indulge in a flight of fancy. Chancellor of the Exchequer Jeremy Hunt and Governor of the Bank of England Andrew Bailey have had a change of career!

The pair take you over to a flashy-looking model with a two-tone, red-and-blue paintjob. A ‘UK Economia 2.3’, say the badges. Freshly-washed paintwork, restored white wheels, a nice clean interior… it looks like it has potential.

It probably won’t have escaped your attention that the car’s enticing looks in this tortured metaphor represent the British economy – and specifically, the promising-sounding fall in inflation announced yesterday.

The headline rate of consumer price inflation fell from 10.1% in the year to March to 8.7% in the year to April. This was the lowest rate of price rises since August and one of the biggest one-month falls in annual inflation on record.

So it all sounds great right? Sign the contract, grab the keys and drive her off the forecourt!

Well, don’t forget to have a root around under the bonnet first. You might just find a few gremlins lurking…

- The inflation figure came in higher than expected – the forecasters’ consensus expectation had been 8.2%

- The core inflation rate, which strips out the more volatile elements of food, energy and tobacco to give a clearer sense of the underlying picture, rose significantly – from 6.2% in the year to March to 6.8%

- Food prices continued to soar, with annual inflation in this area decreasing only marginally from March: down from 19.2% to 19.1%

The simple fact is that inflation is proving much more stubborn to shift than either the government or the Bank of England had expected.

In turn, that means that the benchmark interest rate set by the latter is very likely to rise even further over the months ahead. The rate currently stands at 4.5%; markets now expect a peak of 5.5%. As a reminder, this matters because all rates on new mortgages and other forms of consumer and business borrowing are priced taking this rate into account.

The persistence of inflation and high interest rates undoubtedly poses a challenge for asset markets. However, the Asset Intelligence team – showing up here in their alter-ego recovery-truck overalls – are certainly keeping the tough environment in mind in their fund selection decisions.

The latest edition of the Asset Intelligence Research Fund Panel recommends several high-quality UK equity funds which take a value-focused approach to investment.

Indeed, the research processes for a number of these vehicles involve screening the UK stock market to find companies which appear to be trading at ‘cheap’ levels relative to the market as a whole and other firms operating in the same industries.

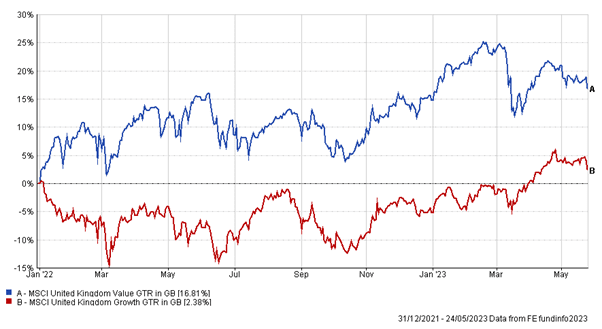

Such funds can be valuable cogs in a portfolio engine at present. High inflation and interest rates tend to see investors favour ‘jam today’ value stocks (companies with lower long-term growth prospects but which make decent profits in the here and now) over ‘jam tomorrow’ growth companies (flashier names expanding fast but where profits lie mostly in the future).

In investment, just as in used car buying, it pays to keep your wits about you, to make sure that what you’re buying is well-maintained – and to go for something which will hold its value in the years ahead.

Chart shows the relative gross returns of the MSCI United Kingdom Value companies and MSCI United Kingdom Growth companies stock market indices between 1 January 2022 and 24 May 2023